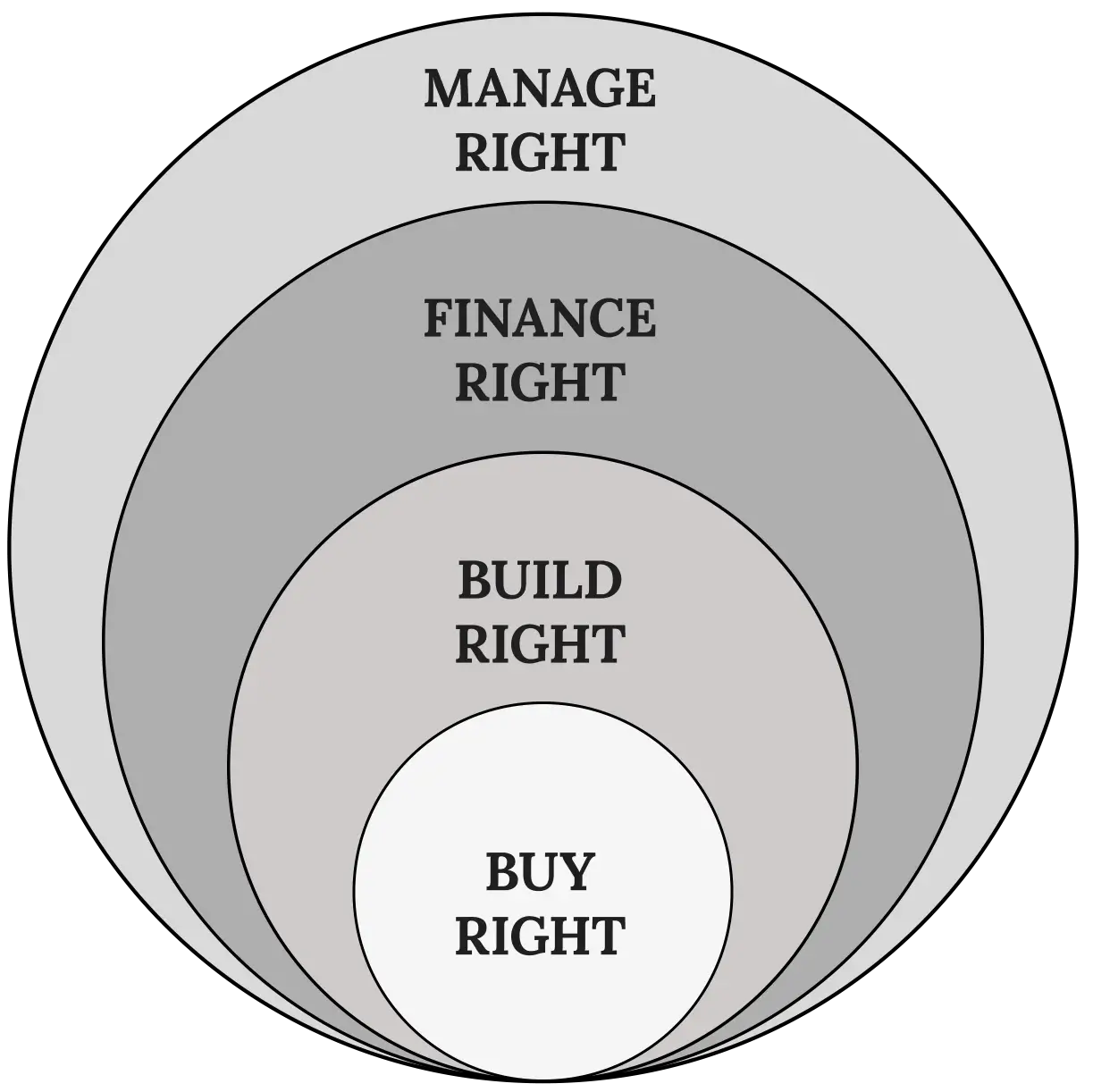

One of the traits that helped Shravan Parsi, entrepreneur, innovator, CEO, and Founder of American Ventures®, achieve stupendous success in the real estate industry was his firm belief in applying the scientific process to everything he touches.

With experience in a variety of industries, including real estate investing and pharmaceutical research, Shravan’s methodical approach to investing in multifamily and commercial real estate was based on his skills as a pharmaceutical chemist. He brought an analytical perspective to real estate, a sector that was very much in need of such an approach.

Since he began his involvement in Texas real estate in 2003, Shravan has co-invested with private equity firms, family offices, high-net-worth individuals, and accredited investors, to acquire 22 apartment complexes totaling 4,300 units, as well as a number of commercial buildings.

In 2022, Shravan won the title of “Top Multifamily Investor of the Year” at the Real Estate Development Awards (RED), popularly known as The Academy Awards of Real Estate, which are presented annually to noteworthy work carried out across the USA.

With experience in a variety of industries, including real estate investing and pharmaceutical research, Shravan’s methodical approach to investing in multifamily and commercial real estate was based on his skills as a pharmaceutical chemist. He brought an analytical perspective to real estate, a sector that was very much in need of such an approach.

Since he began his involvement in Texas real estate in 2003, Shravan has co-invested with private equity firms, family offices, high-net-worth individuals, and accredited investors, to acquire 22 apartment complexes totaling 4,300 units, as well as a number of commercial buildings.

In 2022, Shravan won the title of “Top Multifamily Investor of the Year” at the Real Estate Development Awards (RED), popularly known as The Academy Awards of Real Estate, which are presented annually to noteworthy work carried out across the USA.