high inflation and the multifamily: what investors need to know?

- Free Webinar | Tuesday, October 4th, 2022 At 7 PM CST

- 00Days

- 00Hours

- 00Minutes

- 00Seconds

Webinar highlights

What Multifamily Investors Need to Know About Inflation

Why Can Multifamily Assets Be a Hedge Against Inflation?

Introduction to Multifamily Real Estate Investing

What Causes Inflation and How Is it Managed?

How Inflation Affects Multifamily Real Estate Investments

What Makes Real Estate An effective Inflation Hedge?

People Always Need Housing

New Generations Face Affordability Challenges

The Housing Demand Is On The Rise

Less Sensitive to Volatility

Outperforms Stocks and Bonds

Shorter Lease Terms

REGISTER FOR THE FREE WEBINAR

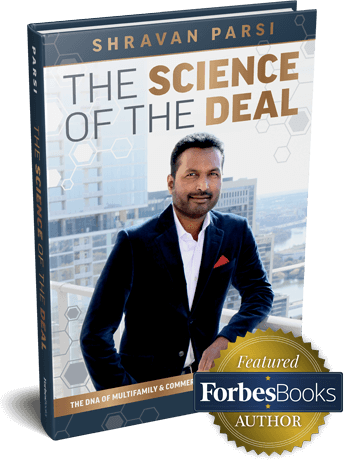

Forbes published Shravan Parsi’s first book

The Science of the Deal: The DNA of Multifamily & Commercial Real Estate Investing highlights

Applying science, analytics and insight to multi-family property investing, Shravan outlines his unique strategy to data-driven real estate investing for modern times. Leveraging deep insight for each deal structure, Shravan outlines how he has built tremendous success through his investment history.

Click Link Below To Purchase Your Copy Today!

Learn how multifamily is an inflation-ready investment asset!

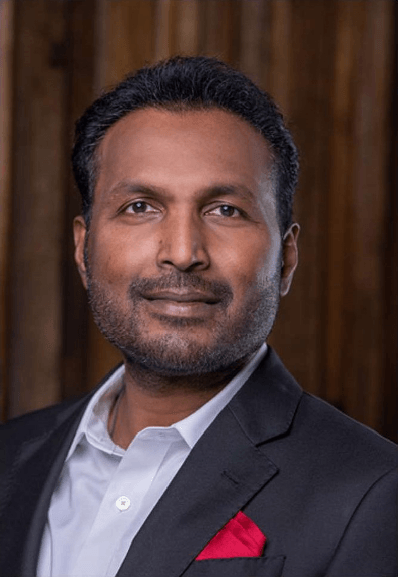

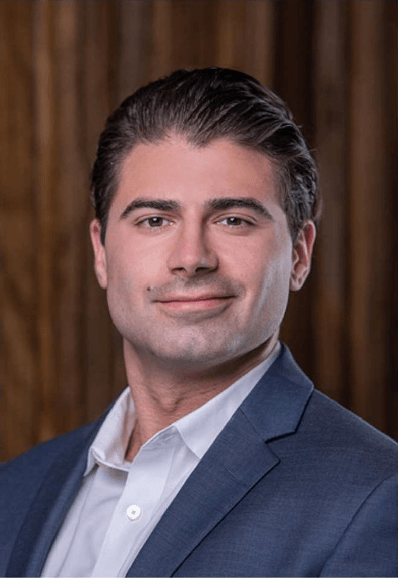

Join our webinar on the 4th of October at 7 pm CST